RWA (Real World Assets) refers to physical assets like real estate, stocks, or commodities linked to blockchain technology. This idea is transforming how assets are traded and managed in crypto.

This text explores real-world asset tokenization, including its benefits and drawbacks, how to tokenize RWAs, and what types suit it.

Real World AssetsTokenization Explained

Real-world assets are physical things like real estate, stocks, or gold that can be turned into digital tokens using blockchain technology. This process, called tokenization, transforms these assets into digital forms that people can buy, sell, or trade-in crypto.

For example, a property can be split into small digital shares, allowing many people to invest in parts of it instead of buying the whole property. This makes investing more accessible and flexible.

Why Tokenization Matters?

Tokenization is changing finance by making it more stable, accessible, and innovative. Real-world asset tokens are backed by physical assets like gold or real estate, making them more stable and less risky compared to cryptocurrencies. This highlights cryptocurrencies advantages and disadvantages, where traditional cryptocurrencies often face volatility, while tokenized assets offer stability through tangible backing.

Tokenization also connects traditional finance with decentralized finance (DeFi), opening new investment opportunities and making asset trading easier. RWA tokens have many uses, like securing loans, lending on crypto platforms, and trading. This gives businesses and individuals more ways to participate in the growing crypto market.

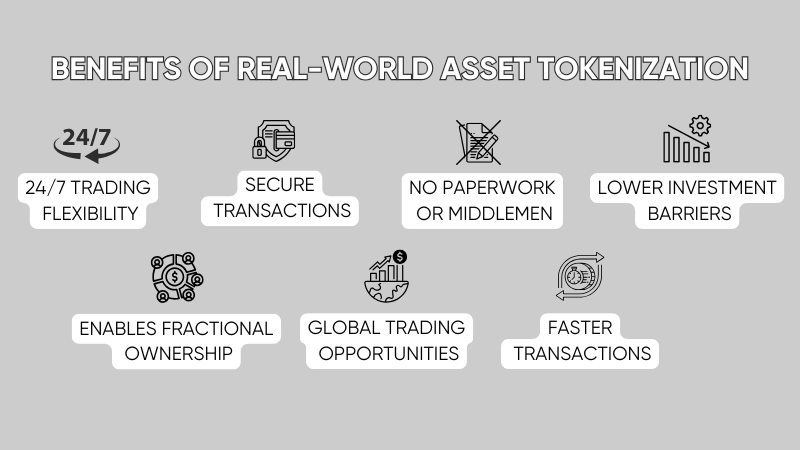

Benefits of Real-World Asset Tokenization

Tokenizing real-world assets provides many advantages, especially for beginners in crypto:

- Tokenized assets can be traded 24/7 on the blockchain, unlike traditional markets that close at certain times. This gives investors more freedom and flexibility.

- Every transaction is recorded on a public blockchain, making it easy to track ownership and reducing the risk of fraud or disputes.

- Tokenization removes the need for paperwork, middlemen, and high legal fees. This makes managing and trading assets simpler and cheaper.

- Tokenization lowers barriers to entry, allowing more people to invest in things like real estate or gold, even with small amounts of money.

- Investors buy small shares instead of entire properties or assets, making it easier for more people to participate.

- They buy and sell tokenized assets worldwide, creating more opportunities.

- Blockchain technology speeds up transactions, reducing delays caused by manual processes or middlemen.

Challenges of Real World Asset Tokenization

While tokenizing real-world assets has many benefits, it also comes with challenges:

- Laws on tokenized assets differ across countries, and many regions lack clear regulations. This creates legal risks and complicates project compliance.

- Tokenized assets are stored digitally, making them targets for hackers and cyberattacks. Strong security measures are essential to protect against these threats.

- Tokenization doesn’t guarantee immediate liquidity. If there’s low demand, some assets, like real estate, may still take time to sell.

- The process of tokenizing assets, including legal setup, blockchain development, and compliance, can be expensive and time-consuming.

- Tokenization can create confusion about ownership rights. If disputes arise, how to resolve them is often unclear or who holds the real-world asset.

- Many investors need to become more familiar with tokenization or distrust blockchain technology, which slows adoption and limits participation.

Types of Real-World Assets Suitable for Tokenization

| Type of Asset | Examples | Benefits |

| Real estate | Homes, offices, land | Buy small shares. Easier to invest |

| Precious metals | Gold, silver, oil, crops | Simple trading, safe digital storage |

| Art and collectibles | Paintings, sculptures, rare items | Share ownership, easier access |

| Stocks and bonds | Equities, securities, bonds | Faster trading, more market flexibility |

| Intellectual property | Patents, copyrights, royalties | Easier to invest, share revenue |

| Infrastructure | Bridges, solar farms, power plants | Raise funds, shared ownership |

| Luxury goods | Watches, cars, wine collections | Buy smaller parts, trade more easily |

How to Tokenize Real-World Assets?

Next, we will talk about how to start tokenizing RWA in simple steps:

- Pick an asset to tokenize. For example, let’s use a $1 million apartment building.

- Determine the asset’s worth. In this case, the apartment building is valued at $1 million.

- Create digital tokens using blockchain technology. You could create 1,000 tokens for the apartment, each representing $1,000 of ownership.

- Make sure the tokenization process complies with local laws. For instance, confirm that selling shares of the apartment through digital tokens is legal in your region.

- Offer the tokens on a blockchain platform where investors can buy them. This allows people to own part of the apartment by purchasing tokens. For example, owning 10 tokens would mean you own 1% of the property.

- Blockchain tracks who owns each token and secures all transactions. This ensures transparency and reduces fraud or disputes.

Example: Imagine an investor buys 10 tokens of an apartment building. They now own 1% of it. They can sell their tokens later or earn a share of the rental income. This process makes it easy for multiple people to invest in one property without buying the whole building.

What Are RWA Coins?

RWA coins are digital tokens that represent real-world assets on a blockchain. They let people trade, own, and use these physical assets in digital form.

How do RWA coins work?

RWA coins are backed by real assets, making them a unique and secure investment option. Each coin represents a specific physical asset, like one gram of gold or a share in a property.

These coins are stored on the blockchain, which ensures transactions are secure, transparent, and easy to track. This reduces the chances of fraud or errors.

Investors can easily buy, sell, or trade RWA coins on blockchain platforms, making it possible to own small portions of valuable assets such as buildings or gold bars.

Examples of RWA coins include gold-backed coins, real estate tokens, and commodity coins. Gold-backed coins, such as PAX Gold (PAXG), are tied to the value of physical gold, providing a stable and tangible investment option.

Real estate tokens, like Brickblock or Propy, represent property ownership, making it easier to invest in real estate.

Commodity coins are linked to assets like oil, metals, or crops, allowing investors to diversify into various physical markets through digital tokens.

Conclusion: What is RWA in Crypto?

RWA are physical assets, such as real estate or gold, turned into digital tokens on a blockchain. This makes trading and investing in these assets easier, more accessible, and secure.

Despite challenges like regulation and security risks, RWA tokenization connects traditional finance with blockchain, offering new opportunities for investors.

FAQs About RWA in Crypto

What is RWA in crypto?

RWA (Real World Assets) in crypto refers to physical assets like real estate, gold, or stocks that are represented as digital tokens on a blockchain.

What are RWA coins and tokens?

RWA coins or tokens are digital representations of real-world assets. For example, an RWA coin might represent a share of property or a gram of gold.

How does RWA tokenization work?

RWA tokenization is the process of turning real-world assets into digital tokens. These tokens represent ownership and can be traded or used on blockchain platforms.

Why is the tokenization of real world assets important?

Tokenizing real-world assets makes them easier to trade, increases accessibility, and lowers investment barriers. Using blockchain technology, it also improves transparency and reduces costs.

What are examples of real-world assets suitable for tokenization?

Real-world assets for tokenization include real estate, precious metals, art, stocks, and even intellectual property. Tokenizing these assets allows fractional ownership and global trading.

What are the benefits of RWA tokens?

RWA tokens provide benefits like 24/7 trading, fractional ownership, lower costs, and secure transactions through blockchain.

How is RWA crypto transforming finance?

RWA crypto bridges traditional assets and blockchain, enabling more efficient, secure, and accessible ways to trade and invest in real-world assets.